The cost of the Companies House Reform

In my previous Insights I have looked at several of the changes due to the Companies House Reform, clearly these changes will result in Companies House incurring additional costs to staff up and update systems to handle the increased powers they now have.

So how will these costs be covered?

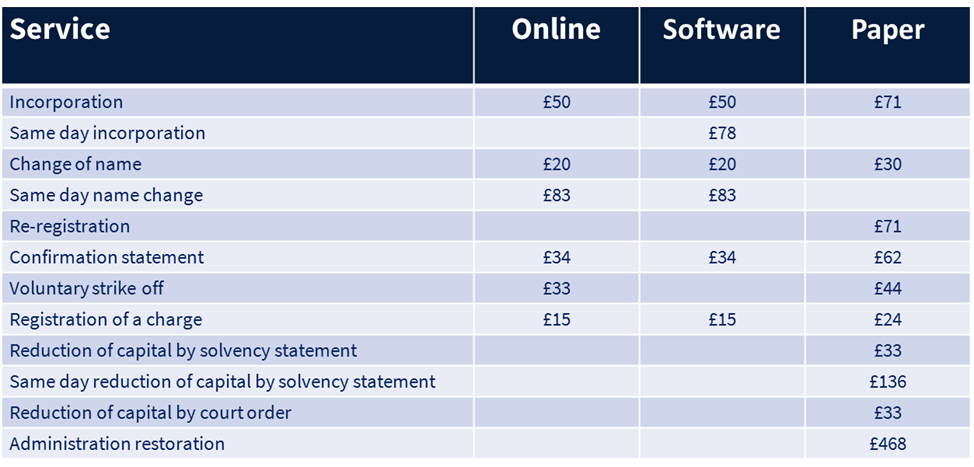

The simple answer is from the users of Companies House, so you. Companies House have increased the fees you pay them for making filings, including compulsory flings. A full list of their fees can be found at Companies House fees – GOV.UK (www.gov.uk), but the below table sets out the new standard Company fees.

Many of the above services may only be required on an ad hoc basis, but the confirmation statement is required to be filed each year, with an increase from the old fee of £13 to £34 if done online or using software, however, this rises to £62 if you want to submit by paper, previously £40. With more than 5 million limited companies registered (per gov.uk), this increase of £21 for filing the annual confirmation statement could generate around £105m of extra revenue for Companies House alone each year.

These changes also reflect Companies House’s push toward digital filings, with higher fees for paper-based submissions. If you are currently making paper filings, please speak to your Ensors contact, as we can help on this front.